On the other hand, paying off credit cards fully guarantees that you will no longer owe that money and you can curtail your interest costs. So if you're really, really lucky, you might earn as much as you would have spent paying off your credit cards, and there is absolutely no guarantee that this will occur. High-Interest Stocksīut what about high-interest investments? First of all, high-interest investments also come with high risk, which means you are more likely to lose your shirt than earn a significant amount of money.Īnd even then, high-interest stocks tend to offer only about 8-10% per year. There is absolutely no investment available on the stock exchange that stands to earn you more than you'll end up spending to pay off the interest on your credit cards if you dawdle. Such bills need to be paid off as quickly as possible. The interest on such financial obligations is often high to begin with (say 7-10%), it can increase dramatically if you fail to make at least minimum payments (double or more the original interest rate), and it compounds monthly (or even twice a month in some cases). What we're really talking about when we say it's better to pay off what you owe than it is to invest is high-interest, compound debt, such as what you carry on your credit cards. And paying down a mortgage does wonders for your credit score. For example, you likely enjoy a pretty low interest rate on this type of lending.īut you also get to write off the interest you pay each year towards your mortgage, saving you on your income taxes. Your mortgage, for example, benefits you in a couple of ways, apart from the fact that you'll own a home once you've paid it off. You should start with an understanding that some loans actually work to your benefit. Let's look a little more closely at the nitty-gritty of what we're discussing here. No matter how you spend your money on Wall Street, there are no guarantees that it will come back to you, much less with interest.

So what do you get from putting your extra cash into investments? There's no way to tell. And you'll give your credit score a boost in the process.

You'll also reduce the amount you would have paid in interest had you not paid the principle on loans early.

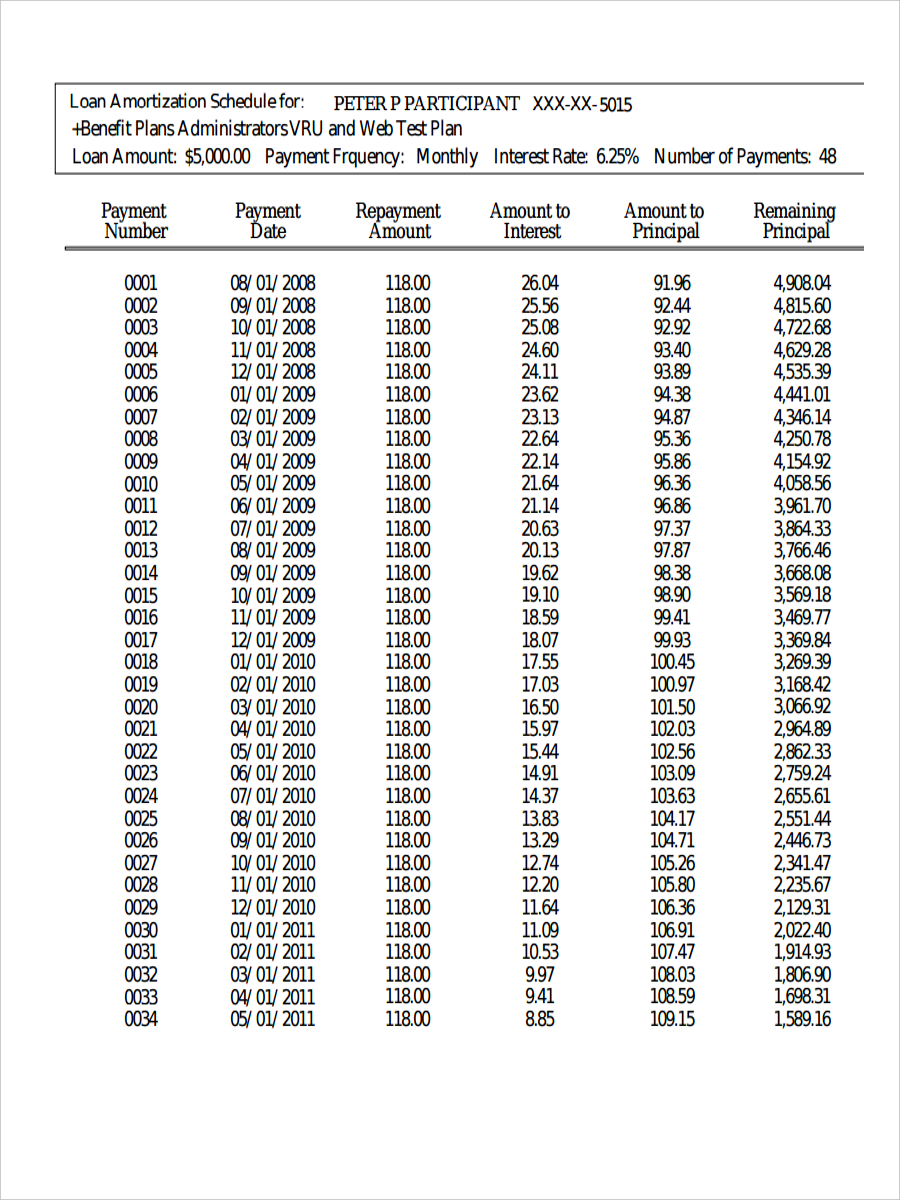

#Amortization schedule printable free

Paying off the balance on a credit card or the remainder of an auto loan more quickly will do a couple of really great things for you.įor one thing, you'll free up some space in your budget, giving you more cash every month to allocate as you see fit - including putting money towards retirement or other investment accounts. Whether you've gotten a raise at work or you've enjoyed a recent windfall, you might have extra cash on hand that you could either put towards lowering what you owe or increasing what you earn.īut you need to consider what each will do for your current financial situation. This is a major factor to consider when trying to determine how best to allocate funds. Here are just a few reasons why paying off lenders is a better option, complete with lower risk and higher return, than contributing to an investment portfolio and playing the stock exchange. But if you speak with a financial planner or simply use common sense, you'll see that paying off financial obligations is the way to go. Your broker may try to tell you differently, and if you don't know a lot about financial decision-making, you could be tempted to take his advice. Paying what you owe first is almost always going to work out better for you in the long run. The truth is that when you run the numbers, you'll see that one option is consistently better than the other in terms of both risk level and financial solvency. So, which is really better for your finances? On the flip side, investing now could help you earn more money even as you pay off what you owe, albeit more slowly. And you can improve your credit score in the process. And there are good arguments for either course of action.Īt the most basic level, paying your creditors will reduce your monthly expenses, leaving you with more money to play with (and potentially invest). To get a home loan amortization schedule with taxes and insurance, please use the amortization schedule with extra payments.There is a lot of debate about whether you should use your money to pay down accounts that are in the red or if you should invest it in a portfolio instead. The simple amortization calculator excel requires only 3 fields, loan amount, terms, and interest rate.

0 kommentar(er)

0 kommentar(er)